kentucky inheritance tax calculator

You would pay 95000 10 in inheritance. States levy inheritance tax on money and assets after theyre already passed on to a persons heirs.

If you make 70000 a year living in the region of kentucky usa you will be taxed 11753.

. Heres how estate and inheritance taxes would work. Among the 3780 estates that owe any tax the effective tax rate that is the percentage of the estates value that is paid in taxes is 166 percent on average. Includes enactments through the 2022 Regular Session.

Your amt tax is calculated as 26 of amti up to 199900 99950. Thereafter the amount of the legacy is taxed at rates ranging from six to 16 percent. Annual 2019 Tax Burden 75000yr income Income Tax 3750 Sales Tax 4500 Property Tax 645 Total Estimated Tax Burden.

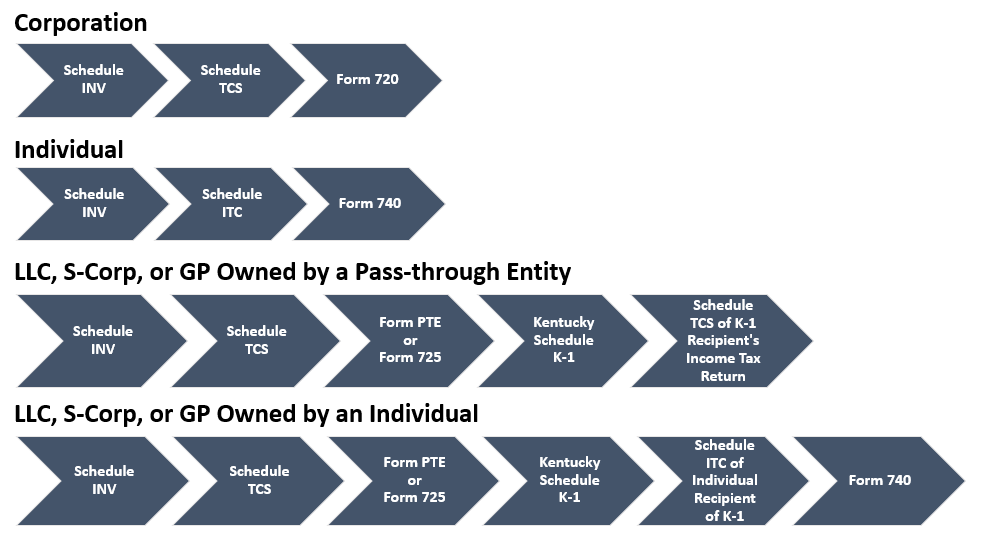

Select the payment frequency from the. Class a class b and class c. Estate and gift taxes the.

Kentucky is one of seven states that has it inheritance tax. Kentucky Income Tax Withholding Calculator. Updated for the 2021-22 tax year.

If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to. After that the tax rate falls between 6 and 16. Inheritance and Estate Taxes KRS 140010 et seq Inheritance tax 416 percent.

The Kentucky income tax rate is 5 for all personal income. In 2022 estates worth more than 1206 million dollars for single individuals and 2412 million dollars for married couples are subject to this tax. You would receive 950000.

The estate would pay 50000 5 in estate taxes. 216 rows kentucky has a flat income tax rate of 5 a. Tom Wilson Last updated.

010 Levy of inheritance tax -- Property affected --. Estates valued at less than these amounts. How Much Is the Kentucky.

The KRS database was last updated on 08092022. The first thing you need to know about Kentuckys inheritance tax is that its not the estate that pays. Legacies to Class C beneficiaries are exempt up to 500.

Kentuckys individual income tax law is based on the internal revenue code in effect as of december 31 2018. The Kentucky inheritance tax is a tax on the right to receive property upon the. The calculation of the inheritance tax depends on what class of heir you fall under and the net estate amount.

How much money can you inherit without paying. KRS Chapter 140. Amounts from 500 to 1000 and above may be taxable depending.

Inheritance tax calculator Estimate the value of your estate and how much inheritance tax may be due when you die. For Class C members only 500 is exempt from Kentuckys inheritance tax.

Kentucky Income Tax Calculator Smartasset

Kentucky Estate Tax Everything You Need To Know Smartasset

Four Things You Should Learn About The Kentucky Inheritance Tax Kentucky North Carolina Estate Planning Attorneys

Kentucky Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Kentucky Estate Tax Everything You Need To Know Smartasset

Calculating Inheritance Tax Laws Com

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

Inheritance Tax 2022 Casaplorer

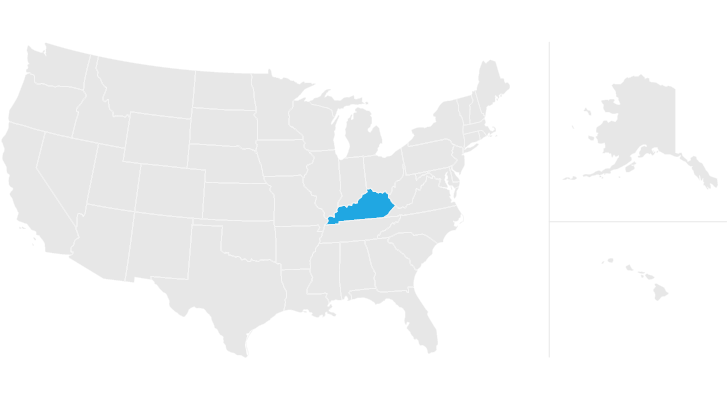

How To File The Inventory Tax Credit Department Of Revenue

How To Calculate Inheritance Tax 12 Steps With Pictures

Kentucky S Inheritance Tax Brackney

Cochran Gersh Law Offices Louisville Ky

Maryland Inheritance Tax Calculator Probate

Cochran Gersh Law Offices Louisville Ky

How To Pay Off Your Mortgage 10 Years Early And Save 72 000

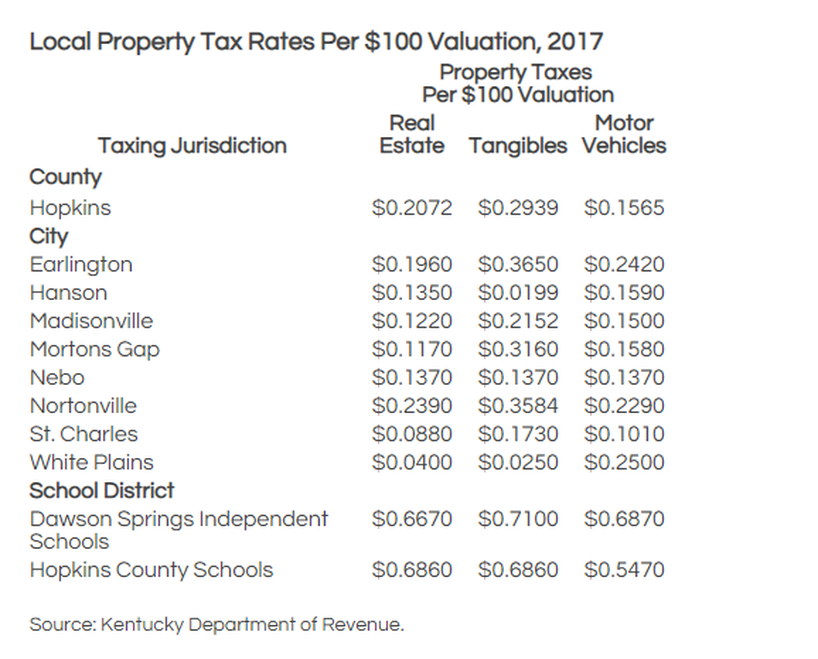

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

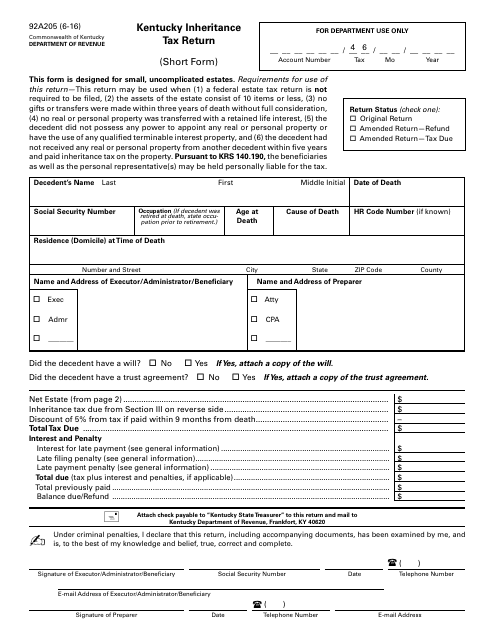

Kentucky Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller